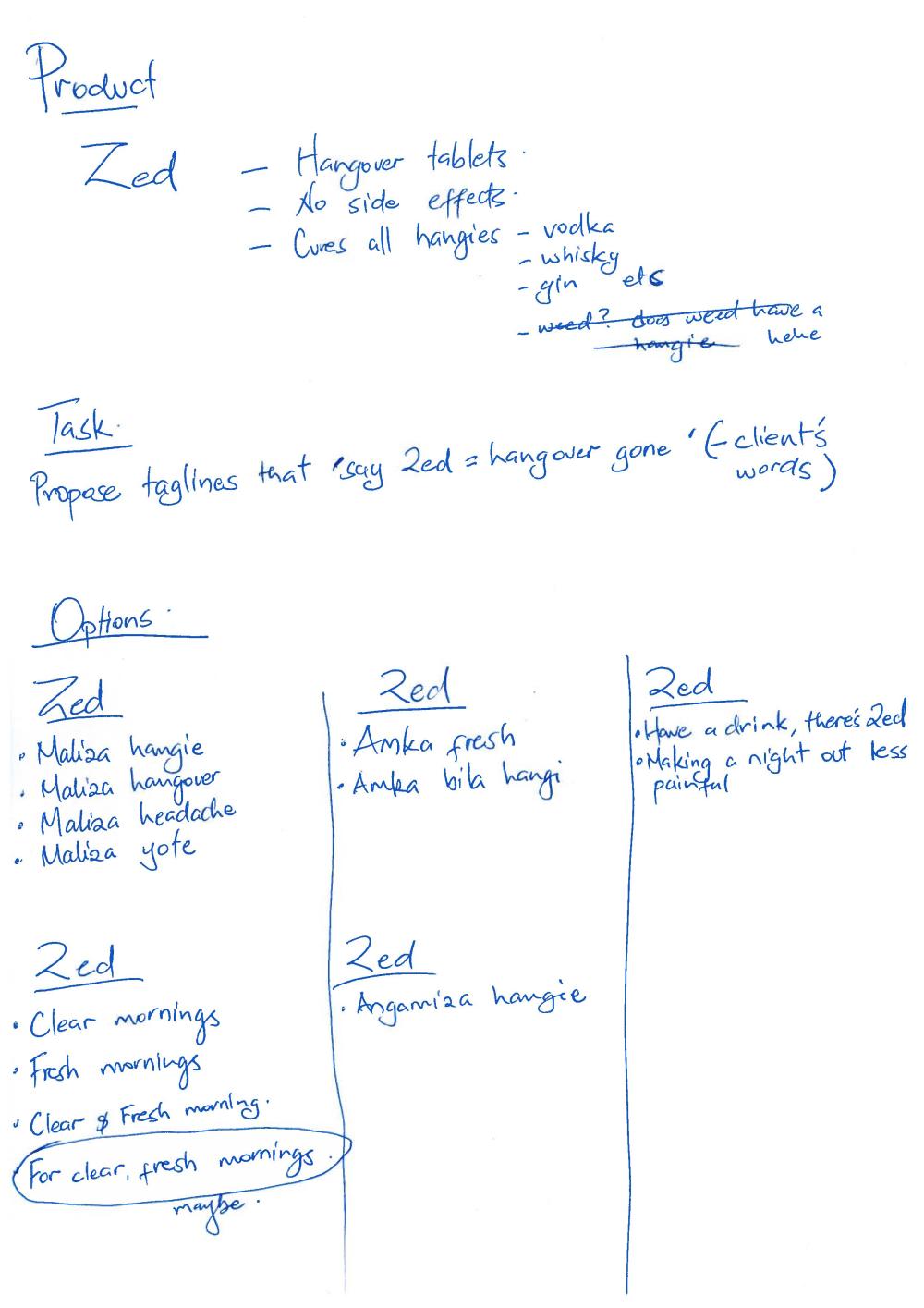

Having done the tagline post yesterday, I thought I’d take it further and do a radio advert script fro Zed, my hangover cure.

Backstory to this is that when I was interviewing for my current job, my Creative Director then asked for a couple of radio scripts to see how I write. So I wrote one up in the cyber cafe and it was about a hangover cure wonder drug.

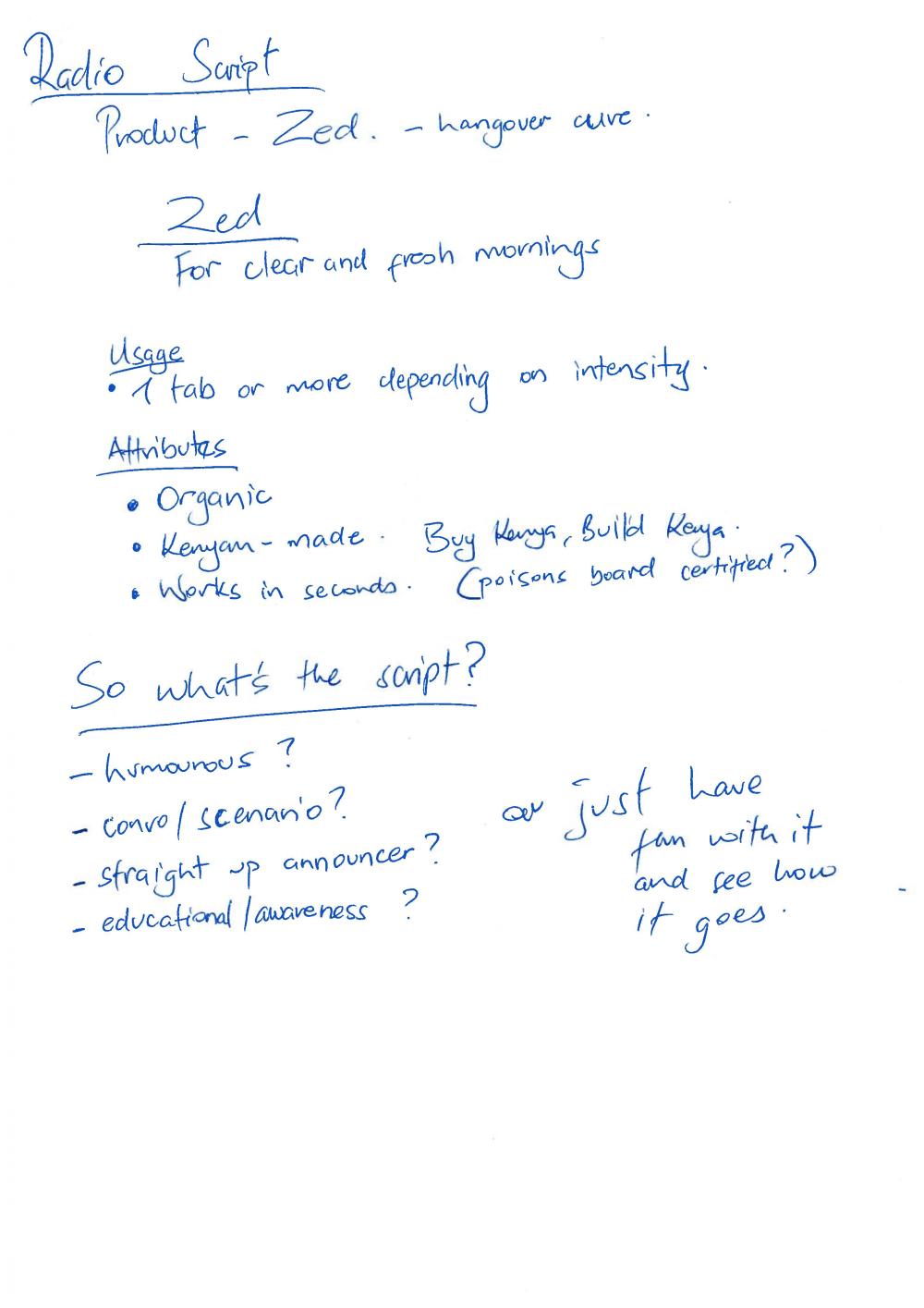

But here’s my process….

Writing scripts is easy, what’s difficult is making the script memorable/interesting one that someone can listen to without cringing or feeling that it is an intrusion to what he/she is listening to. It is always important to know that radio listeners give fuck-all about your ad, that should guide you when starting out.

Humour is usually the go-to device for most writers, it usually works but it does in extremes ie the spot is either hilarious or not, when using humour as your hook, you either get it or not. I usually try and stay away from this because I’m not a very funny person.

On Monday, I’ll post a couple of script options based on the devices in the image above.

How do you write YOUR scripts?

Cheers.